Good morning everyone. This is the Med City CPA. I'm currently reading through the 1040 instructions and I wanted to make a short video about where to report certain items from the 2018 forms, including the W2, 1095, 1097, 1098, and 1099. Let's start with the W2, which includes wages, tips, and other compensations. You should report this on line 1 of the 1040. There are other things to consider as well, such as dependent care benefits, allocated tips, adoption benefits, employer contributions, and more. If you have reportable winnings from gambling, you'll need to use the form W2G. The 1095-A is for the advance payment of a tax premium tax credit. The 1098 is for mortgage interest if you own a home. There are also contributions, loan interest, home mortgage payments, and other related deductions. When it comes to sales of stocks and bonds, you'll need to use the 1099-B. The 1099-DIV is for dividends, including total ordinary qualified cap gains. The 1099-G is for unemployment compensation. Other forms to consider include the 1099-INT for interest income, tax-exempt interest, and interest on savings bonds. The 1098-K is for payment card and third-party network transactions. These forms often require you to use Schedule C or Schedule E. There is also the Schedule 10 for miscellaneous income. Additional forms to be aware of are the 1099-R for retirement distributions, such as from IRAs, pensions, and annuities. There are also forms for royalty income, non-employee compensation, parachute payments, and patronage dividends from cooperatives. Lastly, there are forms for qualified education program payments (1099-Q) and gross proceeds from real estate transactions (1099-S). You may also receive forms for health savings account distributions (1099-SA) and Social Security and veterans benefits. If you're unsure where to report any of these items on your tax return, refer to pages 13 and 14 of...

Award-winning PDF software

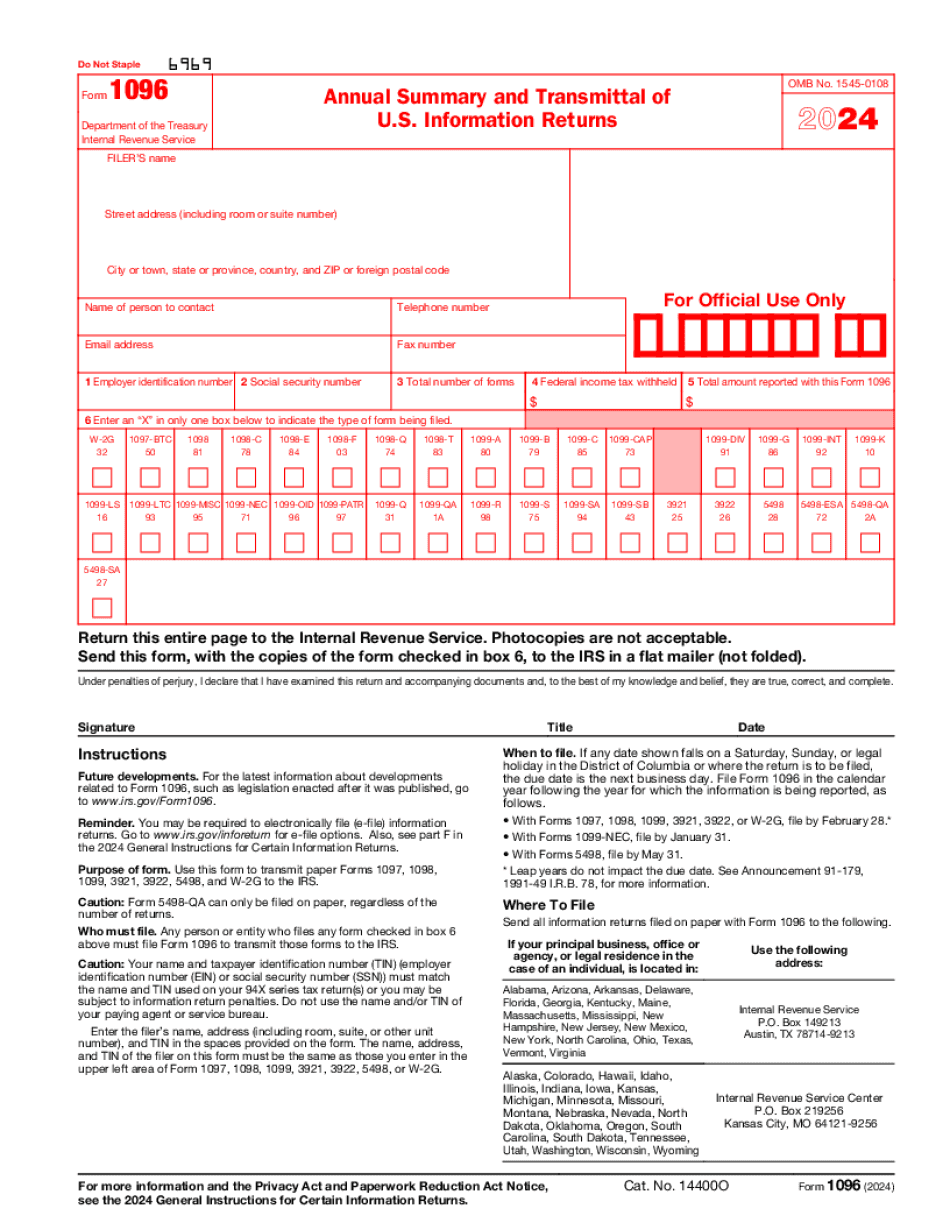

1096 tax 2025 Form: What You Should Know

About Adams 2 Tax Forms, White, 10/Pack Get Adams 2 Tax Forms, White, 10/Pack (STAX109617) at Staples and get free ship on qualifying orders at Staples.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1096, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1096 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1096 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1096 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1096 Tax Form 2025