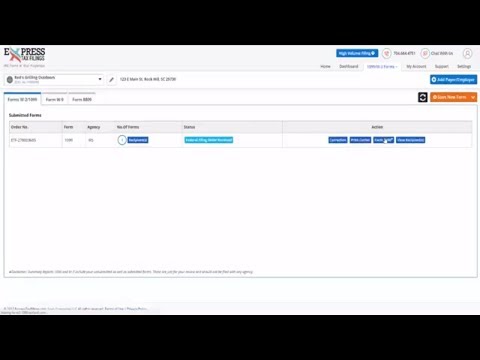

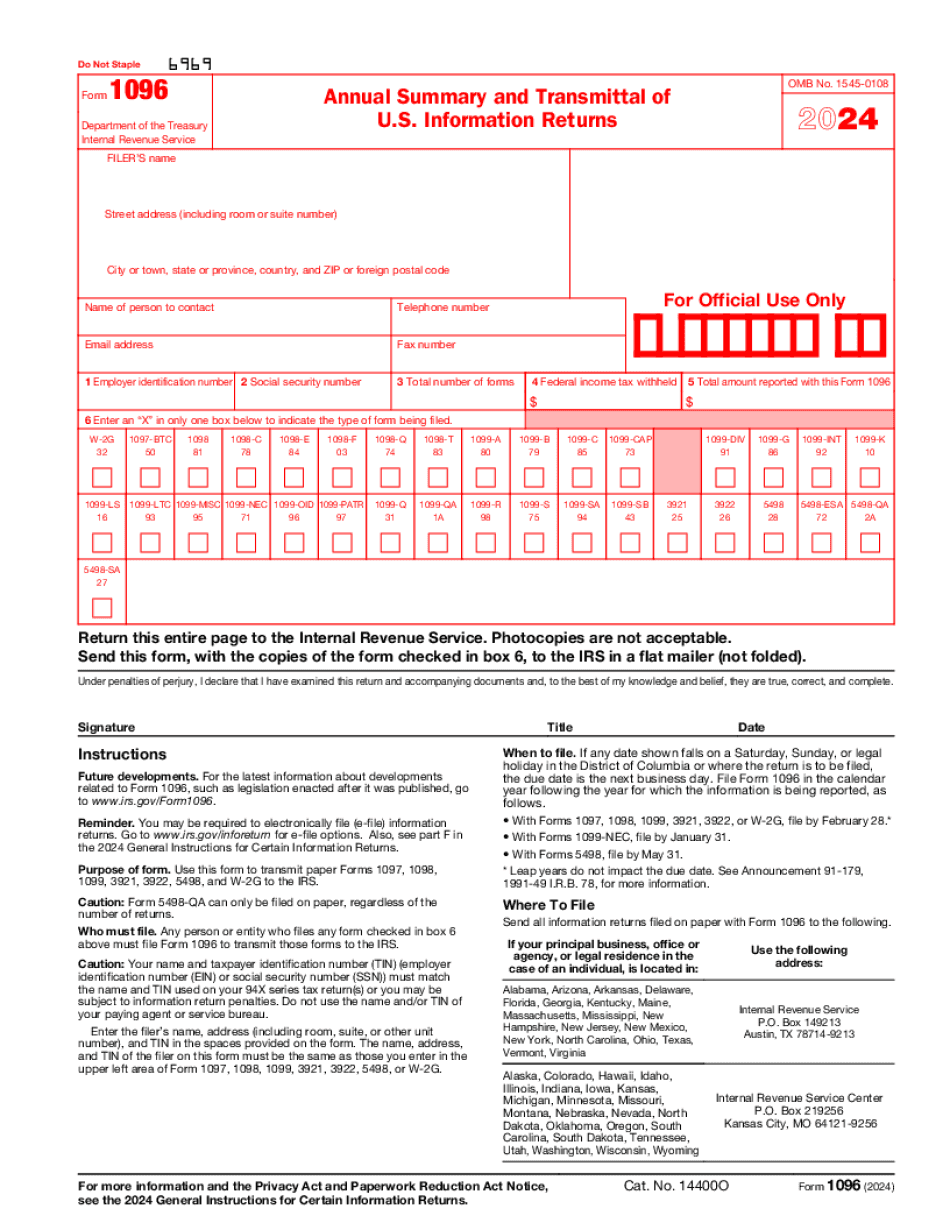

Welcome to Express Tax Filings! We simplify tax e-filing for small businesses and nonprofits. The Form 1096 is commonly used to summarize all the information physically mailed to the IRS. If you choose to pay per file 1099 or W-2, you must send a Form 1096. But each type of form acts as a transmittal document. Form 1096 is not required when e-filing. However, when you e-file 1099 forms with Express Tax Filings, we provide a fixed form that can be used for your records. After transmitting the Form 1099, go to your dashboard and click on Form 1096. You can then open the downloaded Form 1096 PDF for your records. This video was brought to you by Express Tax Filings, helping businesses succeed with online tax preparation. Music.

Award-winning PDF software

1096 due date 2025 Form: What You Should Know

Form 1096: A Simple Guide — Bench Accounting Form 1096, annual summary, and transmittal of Form 1096 and Form 1096B is the tax return template that every filer should use when preparing their income tax return. With Form 1096 Deal, you get a single, easy-to-use summary of all your information for every year, and a clear statement of the tax liability owed each year for all income sources. The Form 1096 Deal: Step-by-Step Guide Why do you need to file Schedule C, with Schedule C-EZ? If you file Form 1040, you have the option of attaching Schedule C to Schedule C-EZ if the amount in box 4 is over 5,000. For this reason alone, I recommend filing it on the lower end. If you filed your tax return using Form 1040, your tax liability as reported on Schedule C will be calculated as follows. This same formula will be applied if you paid the tax with Form 1040 or with Form 1040A. What should I do about Forms 1095-B and 1095-C if I receive them as gifts? If you received Forms 1095-B or 1095-C as a gift, they are the tax return information reported on Form 1096. You can file these returns as soon as you receive the returns -- usually within 10 days or so. (The exceptions to this are when you file a joint return, or file them separately when filing separate returns.) When filing these returns directly from Form 1096, your liability is not counted. However, you can file an amended return after the information reported on the Form 1096 is corrected on your return. Once you get your tax returns, you will need to update your credit card or bank account balances for the Form 1096 returns you filed. You will still have to file those taxes using a separate schedule. What are I-864 forms? These are forms that are used to adjust income tax liability for employees, certain contractors, and certain owners of small business corporations (Sics). You may have received I-864 in the mail as well. Form 1095-B, I-864, Form 1125-S, I-864-A and Form 6485 are examples of the types of forms you may receive.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1096, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1096 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1096 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1096 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1096 due date 2025