Award-winning PDF software

attention filers of form 1096: - internal revenue service

In an effort to protect taxpayer security, please note that the IRS does not accept payment from individuals or entities other than individuals and corporations using the online payment option at If you choose to be paid this way, it is your responsibility to know how to complete your return correctly. We do not accept “charge forms” or any other kinds of payment by check or money order. Please send payment by certified check (made out to the United States Treasury) or money order. No checks will be accepted at the IRS. Do not send payment by credit card (Visa or Mastercard) or personal check. If you send cash by credit card, we will not be able to process your return. Please refer to the instructions included with your return for additional information. I am a resident. What is my filing status? You have a filing status known as.

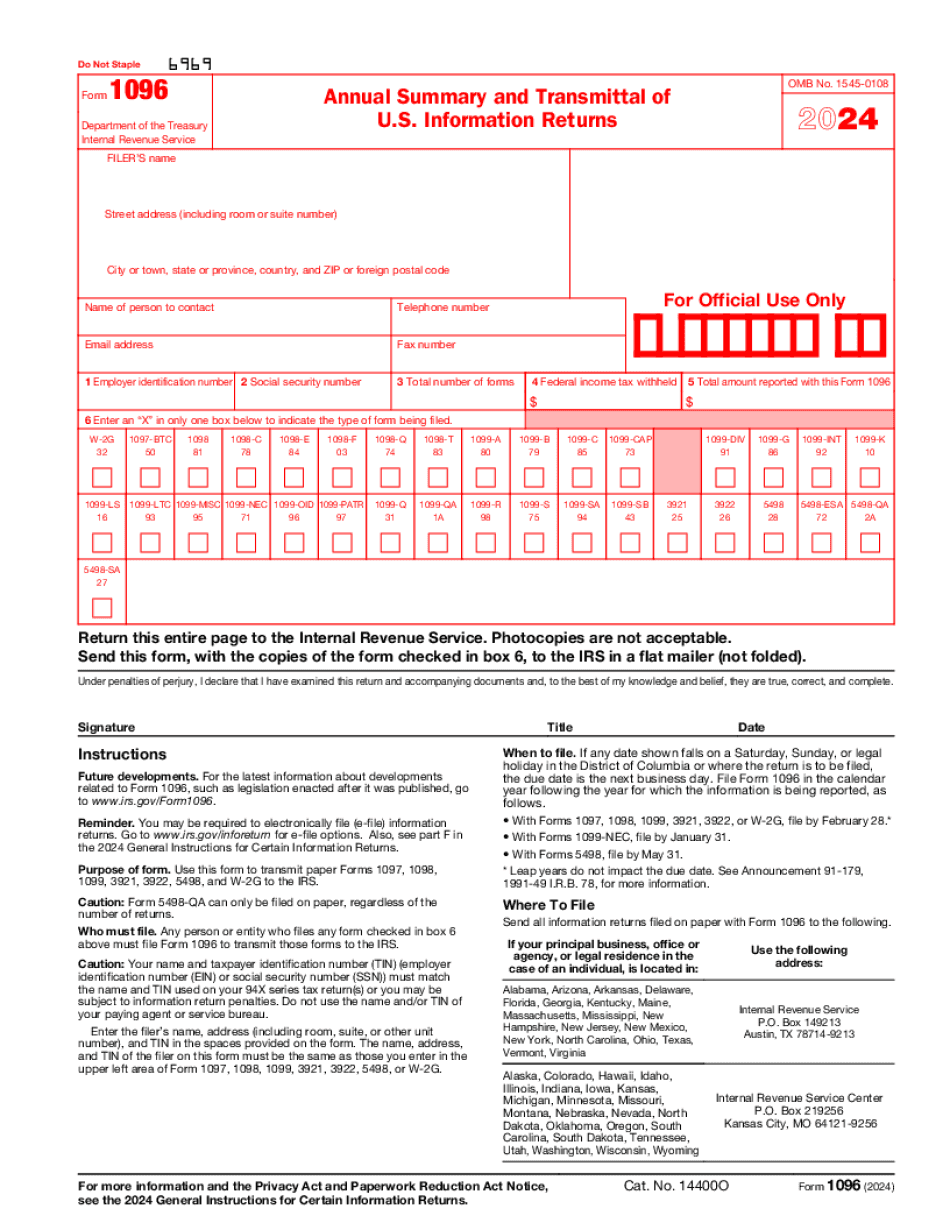

About form 1096, annual summary and transmittal of u.s.

PDF's.

What is form 1096?

How to Claim a Tax Credit for Form 1096? What Other Resources are Offered on the IRS website with Help on Finding Information/Recognizing Claimed Credits/Deductible for a Form 1096? What Type of Forms Does the IRS Issue? What Are Other Types of Forms? “Form 1097-A is an IRS Form that is issued to a payer's representative. “ “Form 1096 is the form described. As you can see, Forms 1097-T, -U, -B, and -S are also forms that are issued to payers.

form 1096 instructions: how and when to file it - nerdwallet

What Americans expect their annual tax returns to be like. If you are an American (meaning you will be filing this year for the first time), you've got very little chance against IRS agents with guns drawn. The tax forms are so complicated that you're not going to get away with saying “I filed it, so I don't know anything about it.” You probably won't even get away with saying “I know nothing about it.” So here's what I'd say. You want them to ask you “Did you file this year?” and say “Yes” or “No,” because that will give your tax preparer a good feeling. What about “Did you file” at the end? They don't know, but if you use the word “returned” it won't matter. What about your tax preparer answering the question. If they ask this question, and you can't get any further, say the.

What you need to know about form 1096 and its due date - hourly.io

A Form 1096 is a one-page document you fill out with information regarding income, taxes, deductions, and credits which are received for your personal tax needs through the IRS. The Forms 1096 are often used for individuals who file and pay their taxes on the due date, but are then not satisfied or feel there are any errors on their taxes on the next business day. Forms 1096 are required by law to be filed by the due date on which they're due, and you should make every effort to do so. Many people are often frustrated with Form 1096 when filing, especially if they realize a deadline is coming up, in which they'll have to fill out more information and submit forms 1096 to the IRS. You should keep in mind that you must complete and sign all the other forms 1093 for a Form 1096 as well, to.