Award-winning PDF software

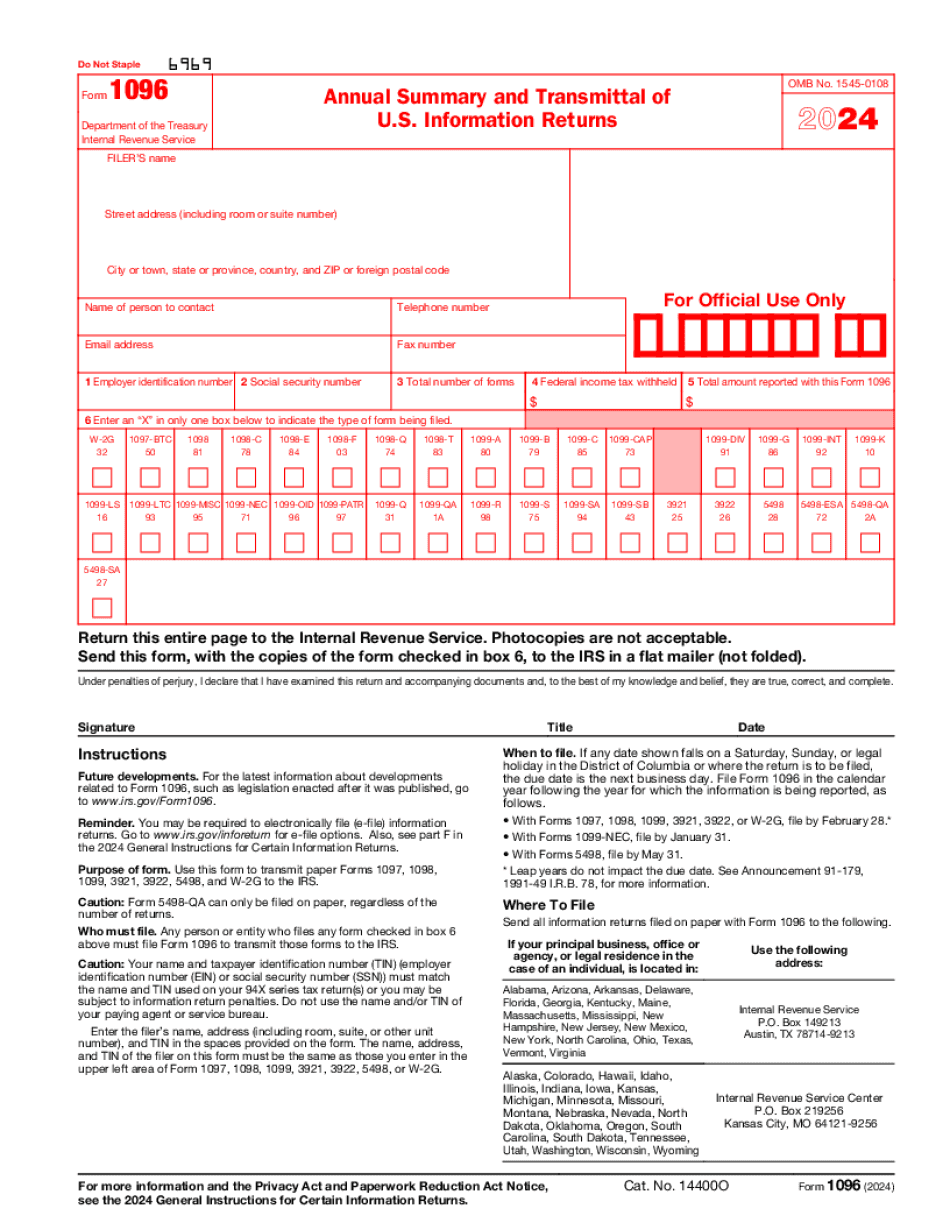

College Station Texas Form 1096: What You Should Know

For example, if a father files for divorce. He's not actually separating from his wife, and he doesn't have to pay child support. IRC Section 7609D — Children of married women in commonwealth of Puerto Rico If you file for a separation and divorce with kids in Puerto Rican commonwealth, you must complete the IRC Section 7609D form. IRS Form 7609D: Children of Married Women In Commonwealth of Puerto Rico For more information about IRC Section 7609D, see IRC section 6966 of the U.S. Code. IRC Section 825 — Marriage Not a Continuation of Active Duty Service — If You Are Attending School or Work During the Year If you're an ex-soldier who is serving on active duty that is in the first or second year. You do not have to follow the 3-year rule. You should submit to Form 709 — Withdrawal from the Active Duty of the Service members for ex-soldiers. If you are in the first two years, you can do the same thing to Form W-2. IRC Section 5695(e) — If You Leave the Uniformed Services Before Completion of Active Duty If you leave the active duty in the first twelve months and complete school or work, submit to IRC section 7609D. If you're still eligible for the exemption at 12 months, you should submit to IRC Section 6706(e). IRC Section 5695(i) — Retirements in Years of Service — The Three-Year Retirement Rule If you have at least 12 months of active (and in some cases inactive) service, and you retire after the maximum service period. You can apply for the 3-year rule to receive full retirement pay. IRC Section 5695(1) — If You Are a Retired Regular Army, Navy, Air Force or Marine. If you have one or more combat-related disabilities, you should submit your Form 709 — Withdrawal from the Active Duty of the Service members for ex-soldiers, Form 8332 — Retired Pay, Form 1099-RR, or Form 5498 — Pay, Allowance or Other Payment Due to an Injury or Illness. Get a letter.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete College Station Texas Form 1096, keep away from glitches and furnish it inside a timely method:

How to complete a College Station Texas Form 1096?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your College Station Texas Form 1096 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your College Station Texas Form 1096 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.