Award-winning PDF software

Form 1096 for Killeen Texas: What You Should Know

The revenue includes an increase in fees for municipal services, city employees, school buildings construction and operations and other fees. It is projected that the entire increase in revenue will generate a budget surplus through the first four years of the budget period. Budget for the first year will be sufficient to pay the employee and other fee increases. This additional revenue for the first five years will be used for capital improvement projects, such as streets and sewer construction. These projects will be funded from existing revenues. May 20, 1997 — CITY OF KILLEEN, TEXAS. ANNUAL BUDGET. FOR FISCAL YEAR '97. City of Killeen has been given more revenue than it anticipated to provide. The revenue for the current budget year will cover costs for the first four years of the budget period, including the annual fee increases for city employees. This additional money could be used for capital improvements to Killeen street repair and improvements to school infrastructure, such as new schools and buildings, or a new public library facility. The budget will fund this work by reducing all operating deficits, and the city is working with the State and the U.S. Supreme Court to address the constitutional issues in court. May 28, 1997 — CITY OF KILLEEN, TEXAS. ANNUAL BUDGET. FOR FISCAL Year '97 through 2018. This will include a budget for the first five years of the budget period. The funds from the new business tax increase should cover the city's costs this budget year. There have been discussions with the City Council concerning a property tax increase for the 2 budget period that would provide some additional revenue to the tax base. However, this increase is contingent upon the U.S. Supreme Court granting the city an injunction to prevent property tax increases. May 22, 1997 — CITY OF KILLEEN, TEXAS. ANNUAL PERSONS BUDGET. FOR FISCAL YEAR '97, '98, '99, '2000, '2001, AND '02. In accordance with Killeen's recent election to extend city residents' current annual property tax rates for the fiscal year ending June 30, 1997. This increase in current law rate will be used to pay the increase in fees for municipal services, including: the City of Killeen Tax Assessor police and Fire/EMS Department all municipal utilities and maintenance costs. all city employees and agency costs.

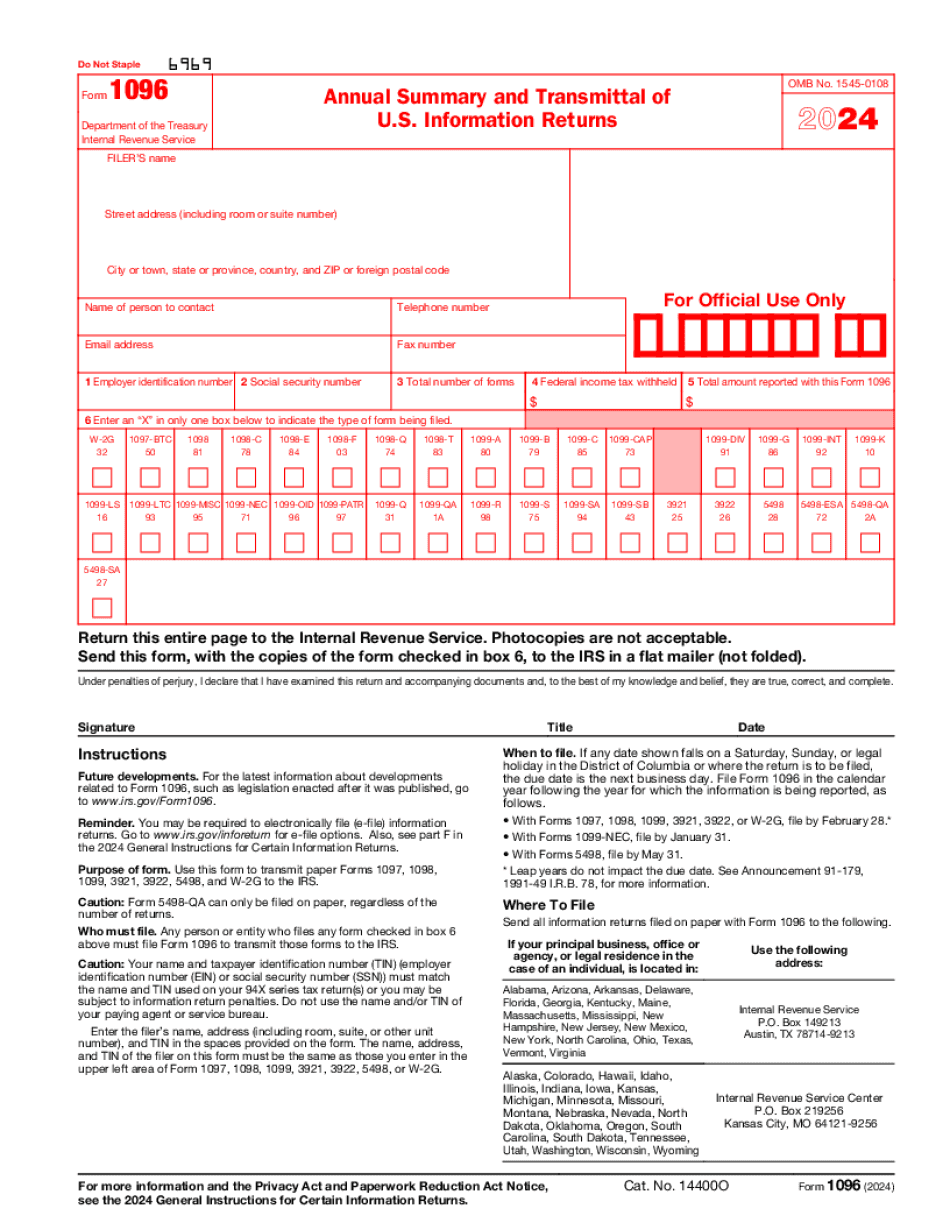

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1096 for Killeen Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1096 for Killeen Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1096 for Killeen Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1096 for Killeen Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.