Award-winning PDF software

Form 1096 Hialeah Florida: What You Should Know

Find out more about us in our online directory or call us at. For More Information. Hialeah, FL Florida Tax Form Questions & Answers The forms, instructions, and other information for completing 1066-EZ are available here from the Florida Department of Revenue. You may contact them at. We also recommend this chart, which lists all the income items that 1066-EZ filers can include on the return, including their federal tax deductions, but not their state tax deductions. If a business has multiple locations in Florida, they must include the business name, EIN, and phone number of each location, as well as any physical address associated with the location. This tax form must be completed for each location; however, a 1066-EZ may be sent to a business based in a different state. For example, a sole proprietor might submit a 1096-EZ for a location with no physical location or in another state, which then would not be required to include the owner's own phone number. Also, the 1066 EZ must be printed if the business has an online presence, such as a website or social media page. A 1066 is also used to report the sale of shares or other property acquired during the year by a non-profit organization. As long as the purchase price is 200 or less (no more than 25,000), only 500 of the purchase price (about 10.7%) must be reported. For a non-profit, only 500 of the purchase price (about 10.7%) must be reported. As long as property is sold at retail, the sale is not to a family member or domestic partner (unless the spouse is not a U.S. citizen). It is considered a separate disposition, which means the taxable gain must be reported separately. Sales of real property that are reported as business income and are more than 100,000 cannot be included in gross income. The seller, of course, retains the title and is not taxed. If the seller's net selling price is more than the fair market value of the property received (or more than 500, whichever is less), no income tax is due. For a list of the most common business tax forms in Florida, visit this page of the Florida Department of Revenue's website.

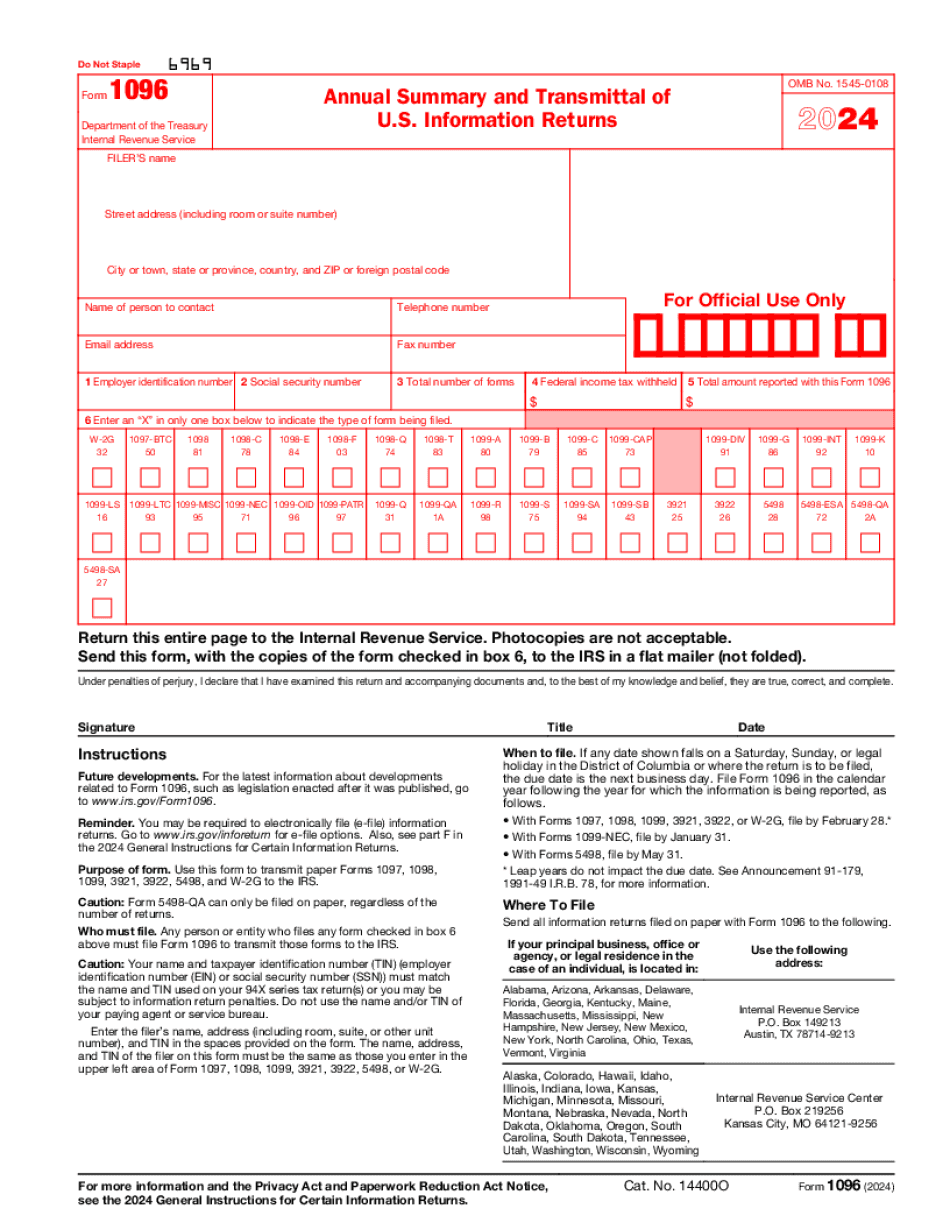

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1096 Hialeah Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1096 Hialeah Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1096 Hialeah Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1096 Hialeah Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.