Award-winning PDF software

Form 1096 online Broken Arrow Oklahoma: What You Should Know

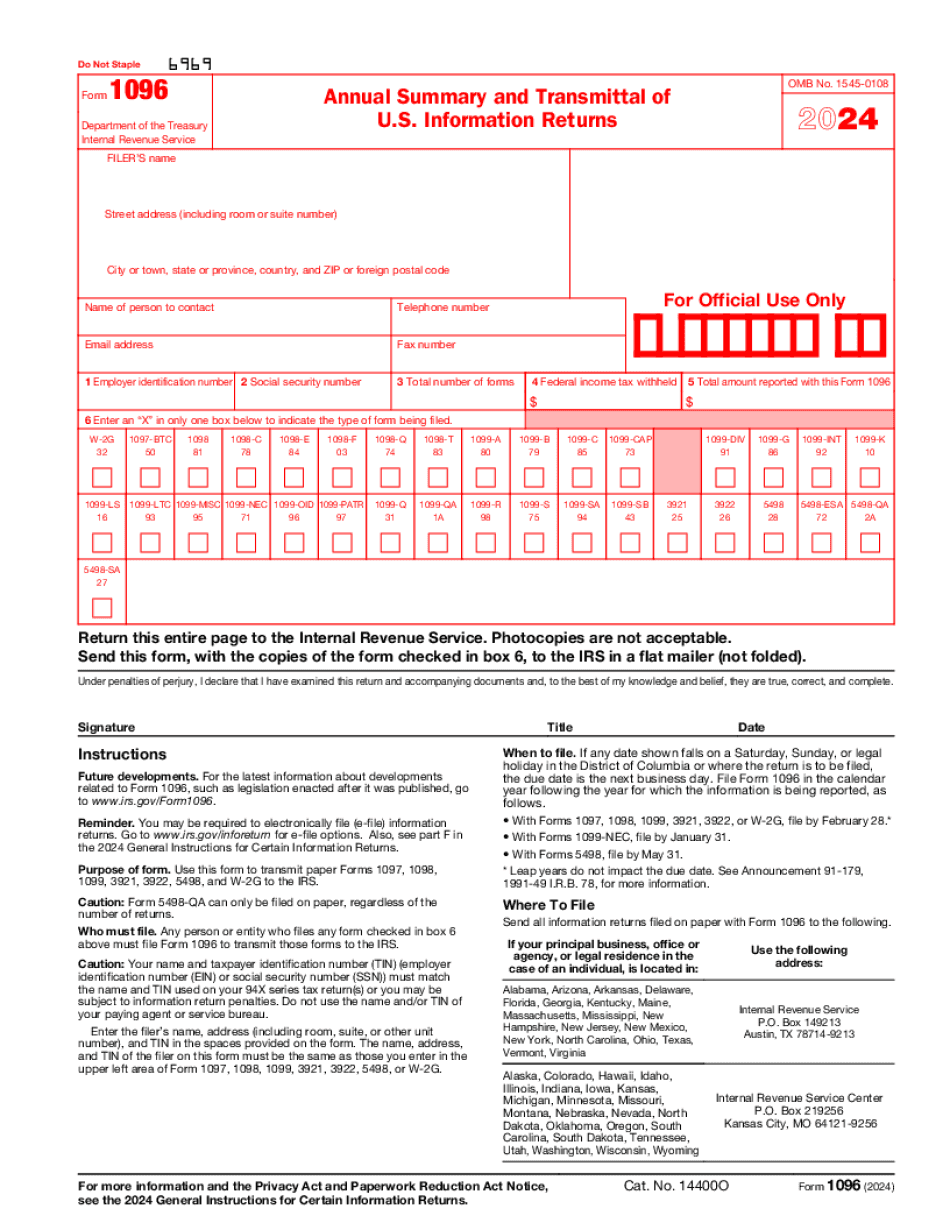

You can create the online IRS 1099 filing for Form 1096. When creating the online 1099 report, use the Form 1096 Online Form (PDF) or Form 1096 Online Instructions (PDF). For more instructions on using the Internet, including how to access Forms 1096, go to Form 1096 Online Guide (PDF). How do I determine if my return is subject to audit? The only way to determine if a return is subject to audit is to check with the Internal Revenue Service (IRS) tax-assessment law enforcement agency that has jurisdiction. For further information on this issue, please visit our Internet website. How do you find the tax year on the 1099? The amount shown as “Total Payments” on the 1099 is the total payment owed to the IRS for all taxes withheld. What are the procedures for filing a return on a non-IRS website? See your individual tax release form (Form 8802) or contact the location of your local IRS office. How do I file for a refund on an online tax return? You can request a refund online through IRS.gov. When filing, be sure to make a good faith effort to ensure that tax information you input is correct. Are tax returns filed on Line 14 to be sent to the correct address unless they are mailed? No. Tax returns filed on Line 14 must be sent to the address indicated by the tax-paying taxpayer. If the taxpayer has changed his or her residence, the taxpayer must advise you of the new address and include a forwarding address. Who do I contact with questions or comments about the 1099? We have provided a list of e-mail addresses for contact with our online support team. Who do I contact for a Form 1096 problem involving paper copies? If you are having an issue when making your 1096 file or your 1096 is not being sent to an IRS address we have not listed here, you may contact us: If you are having an issue receiving a Form 1096, including missing or incorrect amounts, you may contact us. If you are having a 1096 problem related to an e-filed return, you might contact us for help. If you are having a problem while uploading electronic Forms 1096 or when you are submitting an e-Form, you should contact our e-filing support team. For a more in-depth description of the process for e-filing, see IRS.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1096 online Broken Arrow Oklahoma, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1096 online Broken Arrow Oklahoma?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1096 online Broken Arrow Oklahoma aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1096 online Broken Arrow Oklahoma from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.