Award-winning PDF software

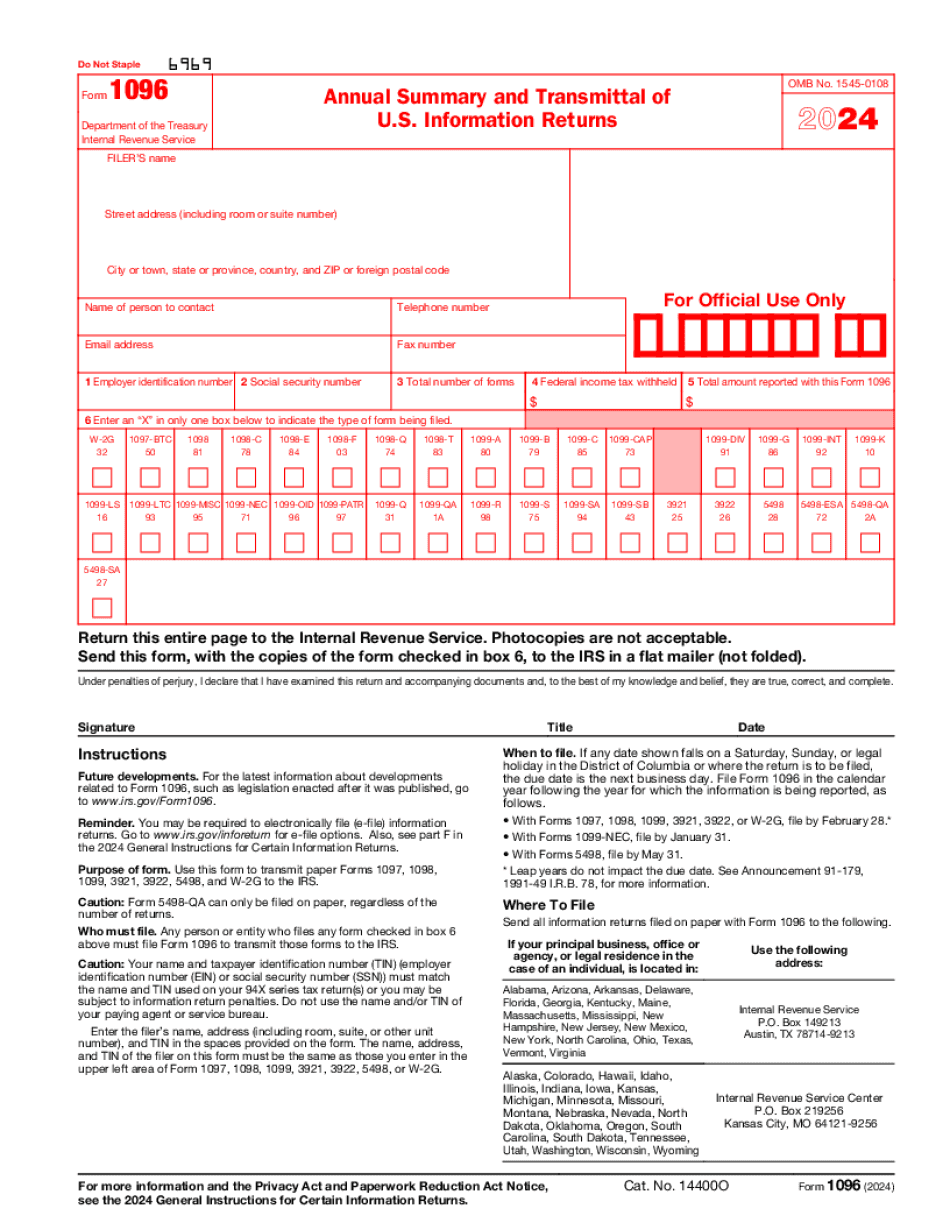

Printable Form 1096 Surprise Arizona: What You Should Know

Form 8001‑5020 The state of Arizona requires you to report your winnings from slot machines, pool halls, raffles, and gaming machines for each wager you make, but does not make you report the wager amount or make you report gambling winnings in other states. What will I report? In a letter dated October 29, 2017, the Attorney General of Arizona released its interpretation of the state's gambling laws in regard to slot machines, gaming machines, gambling winnings, and non-gaming device losses. Specifically, this letter provides you with a detailed list of which forms to submit for reporting on winnings from slot machines, pool halls, raffles, and gaming machines. Read this entire letter. For full details read this letter. For specific rules pertaining to gambling winnings from casino table games and table games at gaming tables, please refer to section of the Arizona Revised Statutes. A form is not required if: You are not a wager giver; You are reporting the winnings for other than one game You must report the loss on the forms required under section. For example, the winnings from slot machines, pool hall, raffle, and gaming machine must be reported on all forms required under section 1128 of the Code of Criminal Procedure. If you have been a licensee for less than one year and are in good standing, and no other forms are required, you are exempt from reporting. We will determine if you are exempt in consultation with the Arizona Department of Gaming (DOS). If you have been a licensee for more than one year, or you were a licensee before this date and no other forms are required, you must enter and retain our electronic records of the winnings and non-income from all games in Arizona for one year. To learn more about this matter, please call, email, or use our contact form. How Many Forms Do I Need From What Gambling Machines? To report any winnings of 600 or more or non-report any loss of at least 600 in gambling winnings that occurred on the slot machines you have licensed, fill out three form W-2G — Wage and Tax Statement, Form W-2G/A, and Form W-2G-EZ. When reporting non-Gambling Losses, fill out three Forms 1099-INT or Forms 1099-MISC.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1096 Surprise Arizona, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1096 Surprise Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1096 Surprise Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1096 Surprise Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.