Award-winning PDF software

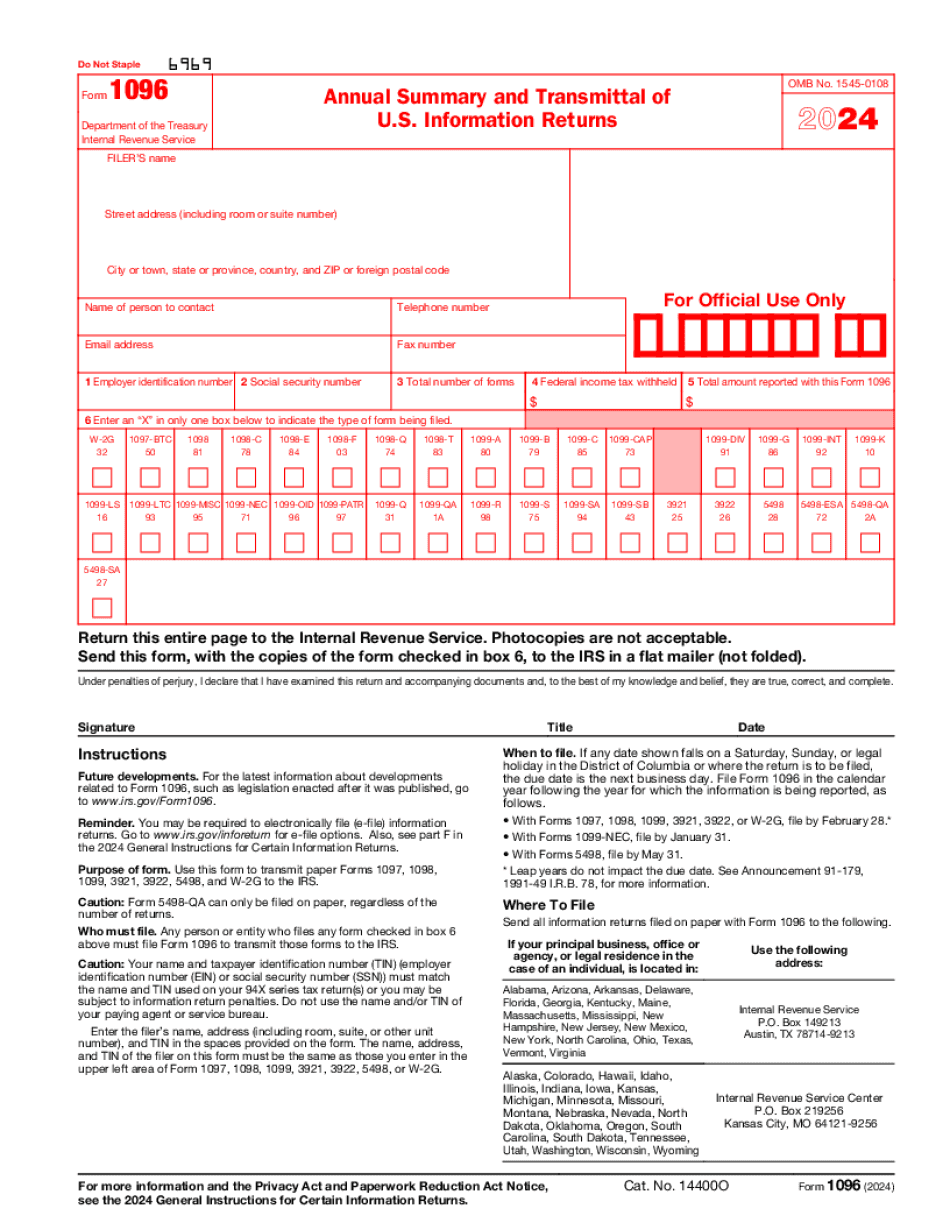

Sterling Heights Michigan Form 1096: What You Should Know

Dissent from the Court A dissent from the court statement: — The opinion states “The statute provides that a taxpayer not only has a cause of action against the Commissioner unless a hearing was held, but also against the officer or official responsible for the violation”. This ruling allows an administrative remedy of paying an administrative fine that can be imposed without court action. However, this ruling is not consistent with this state law's plain meaning. I believe this decision is inconsistent with this state law's use of the word 'cause' meaning 'cause', as well as the statutory definition of cause provided in Chapter 705, Statutes of Michigan, section 705.2. It is also inconsistent with the Supreme Court's decision in the case of Inez v. Northwest Airlines, where the court stated “A person has a cause of action against any person for failing to take reasonable corrective measures when the person's conduct constitutes, or creates a substantial risk of, fraud, dishonesty, deceit, gross negligence or waste of public resources.” In other words, the court stated that an administrative penalty, imposed by a court, is permitted. I am writing this letter to you as a concerned taxpayer to advise you that the IRS and the Government Accountability Office have agreed that the court's ruling on the use of the word cause is a decision based on legal and not statutory interpretation. Therefore, they are unable to accept the court's ruling that a court can assess a civil tax debt against an executive decision maker, for violating policies or procedures that are not in the manner, reason or purpose for which a court of law would have enacted or applied. Sincerely, — Mr. James G.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Sterling Heights Michigan Form 1096, keep away from glitches and furnish it inside a timely method:

How to complete a Sterling Heights Michigan Form 1096?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Sterling Heights Michigan Form 1096 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Sterling Heights Michigan Form 1096 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.