Award-winning PDF software

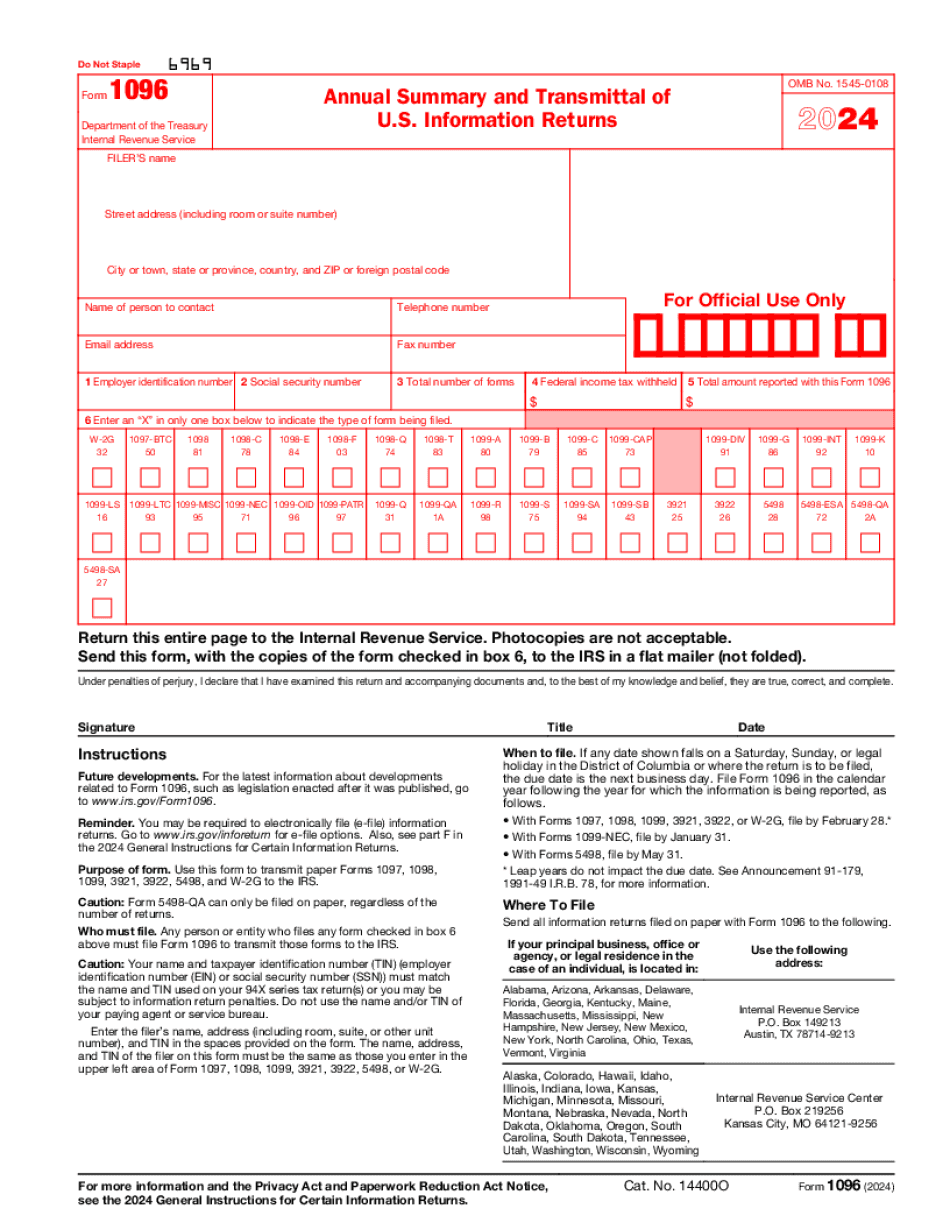

New Mexico Form 1096: What You Should Know

Filing and Payment of Federal Unemployment Tax Aug 18, 2025 — The time for filing and paying Federal Unemployment Tax (FTA) is now extended to the second Thursday in October. That's November 10, 2017, to December 30, 2017. New Mexico's FTA taxes are calculated at 3,000 per person. Tax Rates | Tax Assistance Programs What Are Tax-Deferred and Tax-Assessment Deferral Plans? The following table explains how the tax-deferred, tax-assessment and tax-deferral plans work (based on information contained in “How to File Form 4868 with Your Employer” (PDF), page 3, on page 2 of “How to File Form 4868 with Your Employer” (PDF), Page 4) The IRS provides tax-deferred and tax-assessment deferral tools to help you take money out of tax-deferred and tax-assessment accounts so that the funds can be used at a later date. The IRS doesn't allow you to take money out of tax-assessment accounts. If you have a tax-deferred account, and you need money out of it, do this at your own risk. When using these programs, be careful to meet all the requirements and avoid having your account balance increase before you are required to pay taxes. The rules are complicated, and we cannot provide detailed instructions for you or anyone else. When to Use a Tax-Deferred Account or a Tax Accrual Account? The IRS requires that certain amounts be deposited with your RESP or RIF. However, there are situations in which it might be more advantageous to deposit the money with a separate account. A tax-deferred account allows you to keep your earnings and to build up cash-flow in future years. Using one will allow you to save money each year. It is less expensive to maintain than a 401(k) account, which usually has a 25.00 contribution limit regardless of how much you make during the year, but the IRS may charge a penalty if the earnings cannot qualify you for the maximum tax amount (currently 54,000) when you reach age 70½. A tax-assessment deferral account allows the IRS to take money out of your account each year. These accounts do not make you liable for taxes until they are reached or until the following year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete New Mexico Form 1096, keep away from glitches and furnish it inside a timely method:

How to complete a New Mexico Form 1096?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your New Mexico Form 1096 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your New Mexico Form 1096 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.