Award-winning PDF software

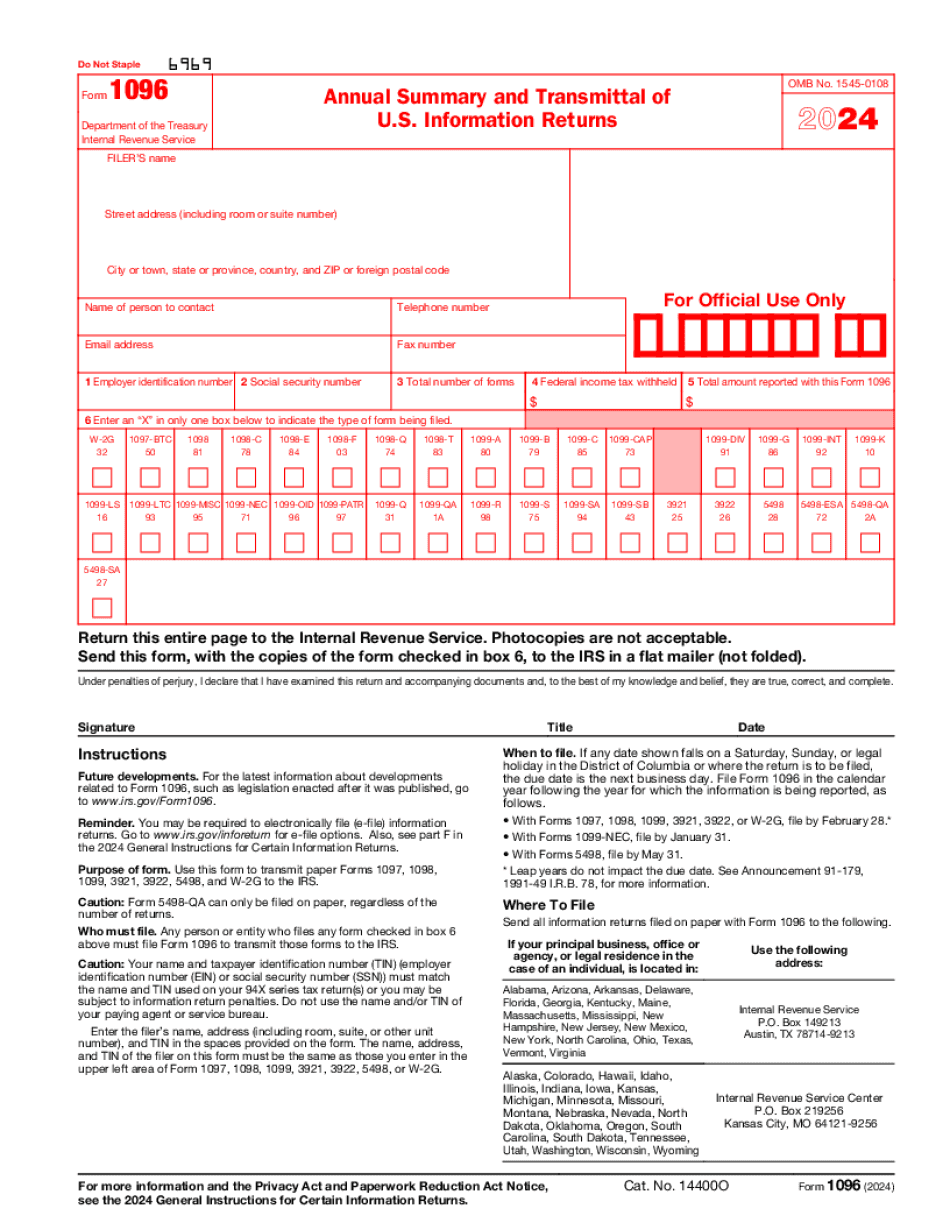

OK online Form 1096: What You Should Know

Available as a complete software package. Form 1096: Don't miss these two important deadlines! Oct 13, 2025 — Taxpayers are required to pay their 2025 filing obligations by April 16, 2019. Incorporate a W-2 | Form 1096 | Form 1098: What You May Need Oct 18, 2018— Incorporating a W-2 is a good way to avoid double taxes on your wages. Read more. What You Need to Know Before Filing the 1098’T Oct 23, 2018— For the 2025 tax year, you must include a Form 1098’T to report any foreign earned income and/or withholding for the federal income tax. Read more. Form 1095: Taxpayers Who Are Over the Age of 65 and Are a Resident of a Senior Citizen Community Oct 23, 2018—The IRS issues Form 1095 with a one-year extension for filing for the first time at age 65 or later. Read more. IRS Tips: What To Bring to a Tax Consultation Oct 25, 2018— Find tax tips from the IRS on this page for taxpayers filing on time with the IRS who aren't represented by an accountant. Related IRS Questions & Answers How Do I Use My Credit Card While I'm Preparing for the 1099-MISC? July 2018— The amount you paid with a credit card does not have to be reported with the 1099-MISC for payments received through PayPal, Square or Venmo. What If My Employee Wants My Credit Card Information? May 2018— A few weeks ago, a reader asked me about what to do if your employee wants your credit card information. After thinking about it for a bit, I figured it's not a big deal, and I'll just keep writing. I may add other helpful information on this FAQ page in the future. Check back in a couple of months. IRS Tips: Employee Reporting Requirements June 2018— Here are a few more tips about using a credit card. How Can I Use Money I Already Received? June 2018— I think this is a fairly common question and there are two answers to this one. First, you can keep any amount you have received and use it up at the end of the year on whatever you'd like. Second, you can use any amount you have received and keep it in your bank account.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete OK online Form 1096, keep away from glitches and furnish it inside a timely method:

How to complete a OK online Form 1096?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your OK online Form 1096 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your OK online Form 1096 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.