Award-winning PDF software

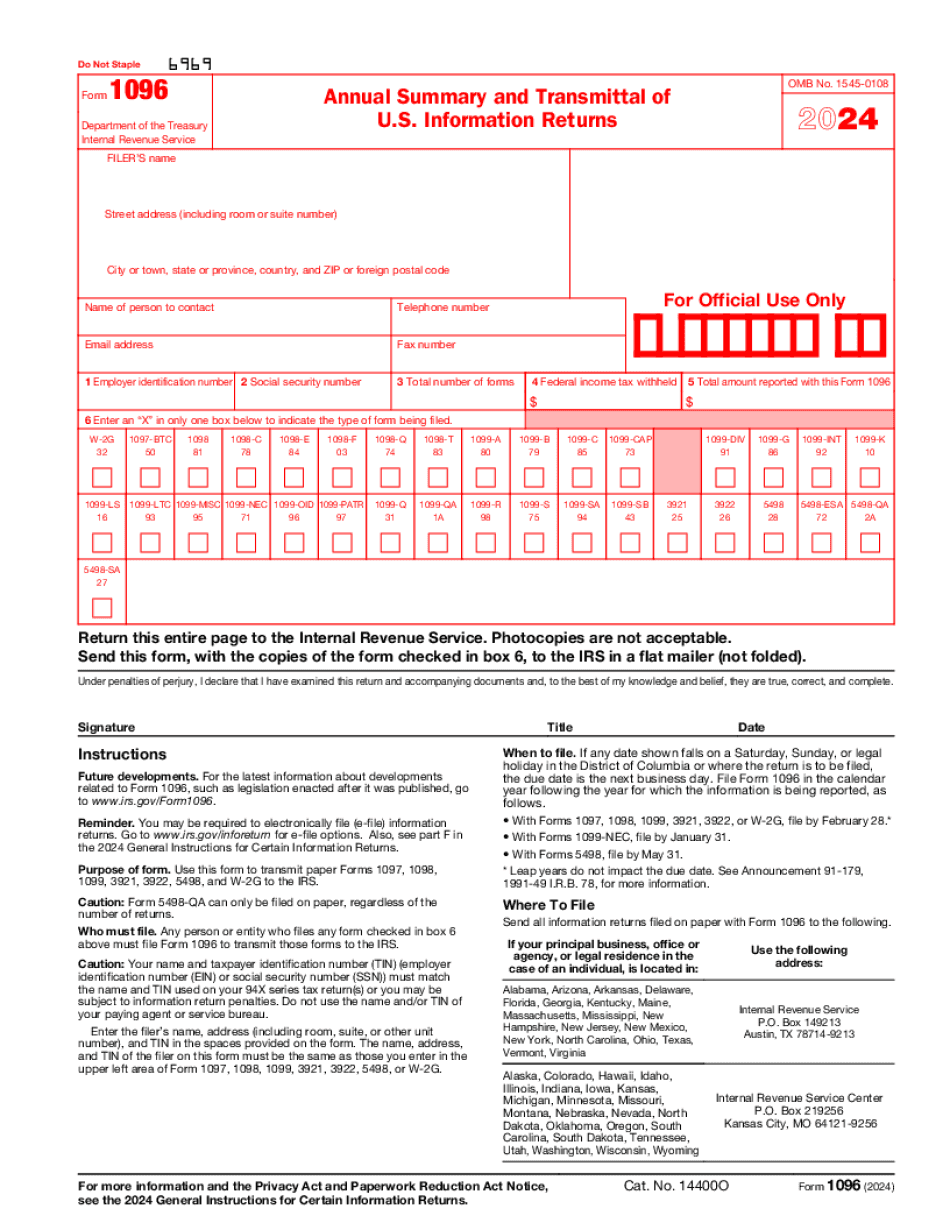

Printable Form 1096 Rhode Island: What You Should Know

To download files or print the Forms, please download the PDF version first from this website. For a list of available forms, go to: The form RI-1096PT is used to report the Rhode Island withholding of a 1096 payment voucher. The ten-point formula specifies that the payment must be allocated as follows: Amount of payment voucher for tax year 2043 and its first full tax year (or the amount determined by reducing taxable income from its last full tax year by the amount of the grant) in percentage of basic exemption amount. (Form RI-1096V) Amount of payment voucher for tax year 2043 and its first full tax year (or the amount determined by reducing taxable income from its last full tax year by the amount of the grant) in percentage of basic exemption amount and additional personal exemption amount. (Form RI-1096V) Amount of grant that the granter can claim for income tax liability of the granter's noncitizen children (and a parent or parents-in-law) under section 117E (relating to dependent children). (Form RI-1096V) The amount of gross income tax allowed by this Section on income derived from the granter's grantor-subsidiary corporations. (Form RI-1096V) Other relevant information. This form to be completed under penalty for filing without the required tax return by the 25th day of the last month of the tax year. Form RI-1096PT is used to report the Rhode Island withholding of a 1096 payment voucher to the recipient as specified by the 1096V. See R.I. Code § 4-11-1.10. For the full version of this form for the entire three tax years (1943 to 2050) please see: If you need a printer that is not listed here, and you are unable to download any of the forms provided there you can use the free Microsoft Word or Adobe Acrobat Reader available through a variety of online vendors through a list of vendors. (See here if you need help finding that vendor). You can print forms online and send them electronically to the Rhode Island Revenue Department, Division of Taxation, PO Box 65941, Providence, Rhode Island 02905.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1096 Rhode Island, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1096 Rhode Island?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1096 Rhode Island aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1096 Rhode Island from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.