Award-winning PDF software

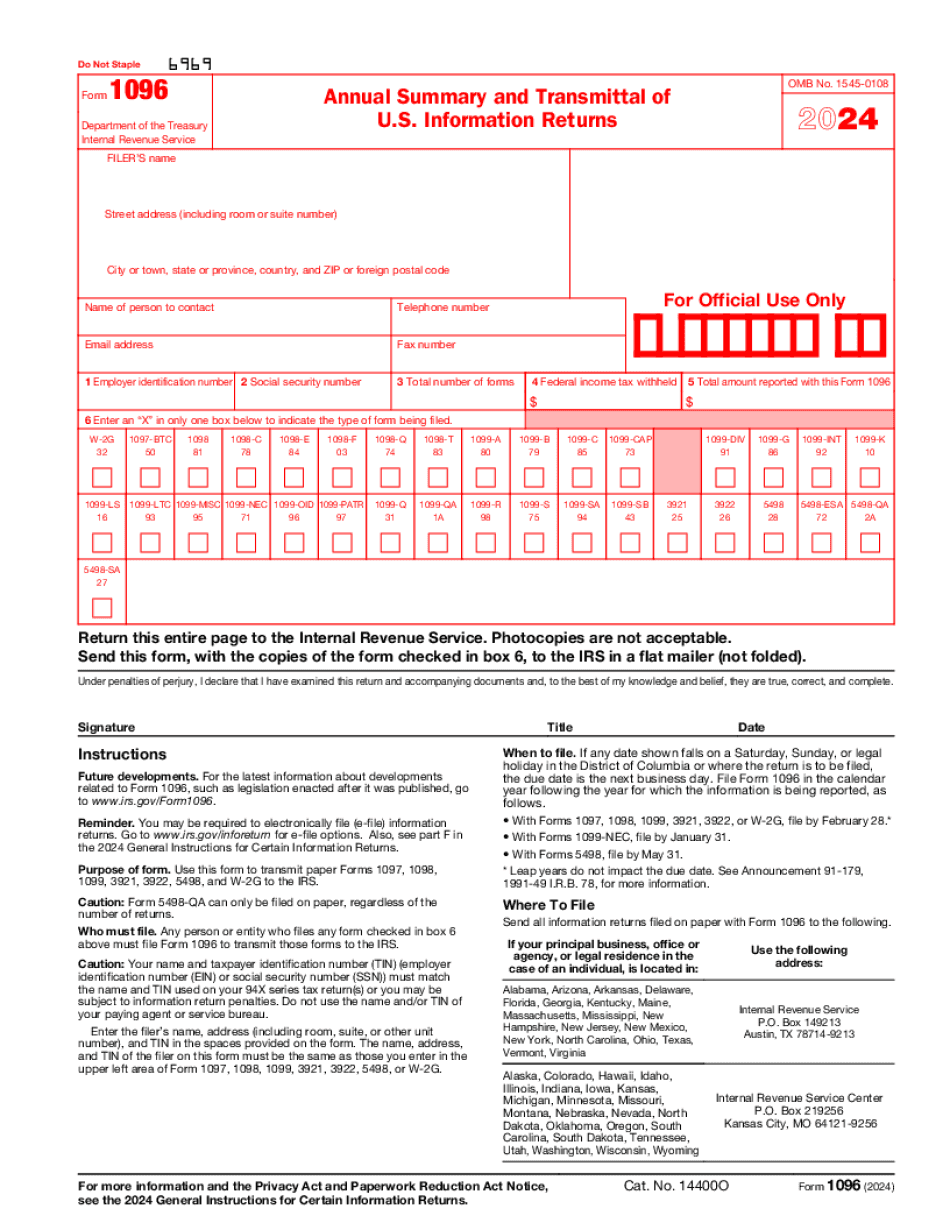

The one-page template is a cover sheet or brief report of non-employee income that must be mailed to the Internal Revenue Service.

What Is the Purpose of the Irs Form 1096?

The document is a summary showing information about the total number of returns. With the help of a doc like this, particular types of transactions are reported to the Internal Revenue Service as well as to the individual who received income from the transaction. Tax-exempt organizations use this tax blank to prepare their federal filings, even though they are not required to pay certain taxes.

When Is Tax Form 1096 Due?

Most information returns are to be submitted to the IRS by February 28 of the year after the fiscal year. If you file electronically, the period is extended for 1 month (till March 31).

What Is the Penalty for Filing Form 1096 Late?

If you submit the document within a month after the deadline, the penalty will be $50. After that, the fine increases twofold costing $100.

How to Change the Irs Form 1096?

Have a look at the list below and follow the steps for correcting your document:

- Complete a new template with the new information.

- Check the box at the top of the doc to point out the filing is an amended version.

- Complete and attach the tax declaration to specify what and where you are correcting.

- Submit the amended tax blank by mail or e-mail.