Award-winning PDF software

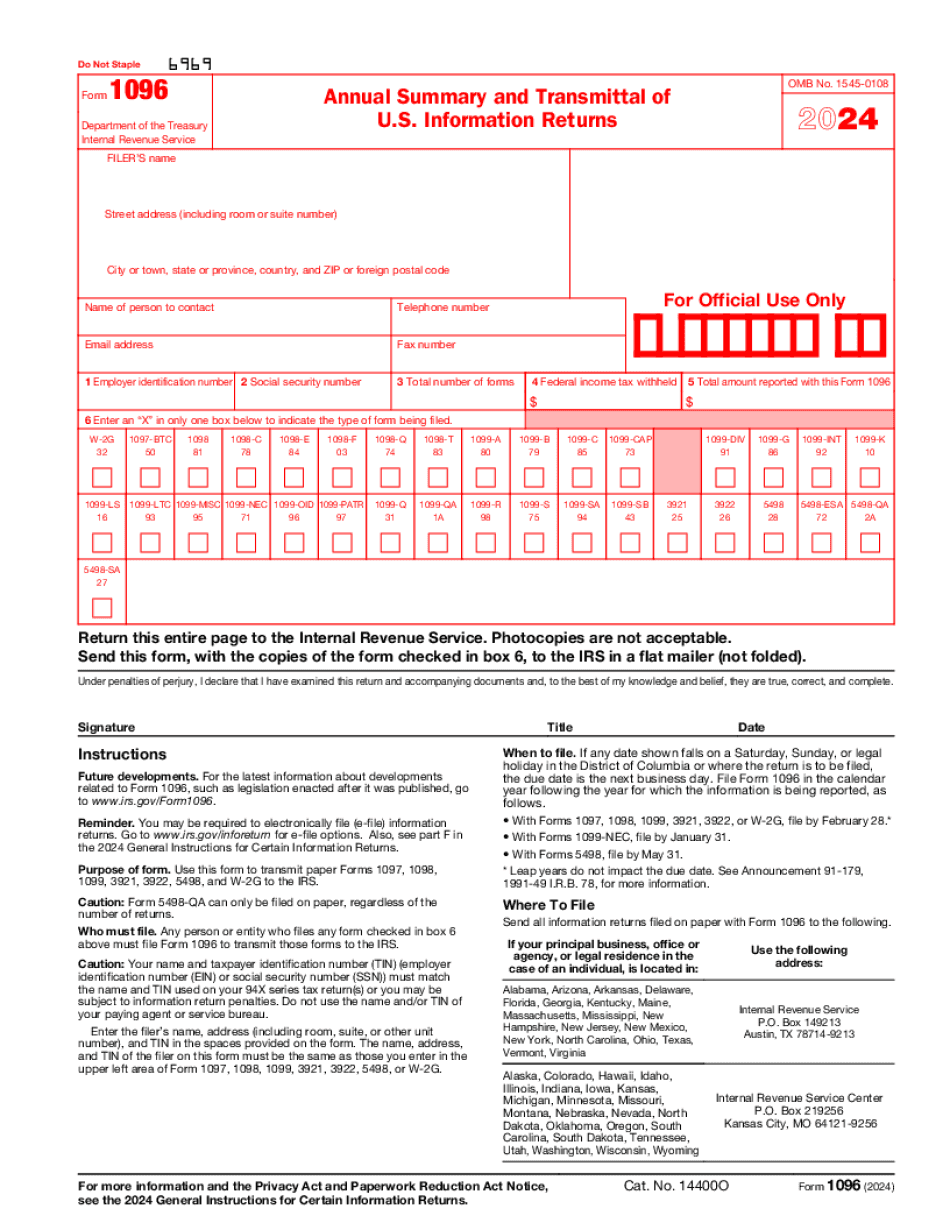

Chandler Arizona Form 1096: What You Should Know

The IRS has created a handy form for those tax professionals and others who want to file their quarterly or annual Form 1099. The IRS 1031 information for filing taxes and information The IRS released a new version of its Form 1099-OID. This new version can be used to claim the employee business deduction in lieu of paying the federal and state Social Security (FICA) taxes. The IRS 1040 Individual Tax Filer's Return & Tax Withholding Information This is the next available copy of the 1040 tax return. It provides information on federal and state FICA taxes and the federal alternative minimum tax. See what types of income are considered business income for federal taxes? This Taxpayer Guide provides further details on tax-related tax issues such as FICA, FRS ICA and federal Medicare taxes. This guide will help simplify information provided in the 1040 form and will help prepare your 1040 to help ensure that you are not under filing or over filing your tax returns. IRS 1040 (Amended) The 1040, filed under the previous 1040C and 1040E forms, will be phased out starting January 1, 2009. It's the next available government-issued version of the form. The 1040E form will be used by taxpayers to report only the earned income for tax purposes. IRS has published guidance about whether a taxpayer can use the 1040E form to claim an earned income credit (EIC) or a Social Security adjustment (SSA). However, the 1040E form is NOT available for used to claim either an EIC or SSA. It will become obsolete as of the first day of the next new tax year (beginning with 2009, the most recent return filed after January 1, 2009). This IRS tax information from the 1040 form and summary includes: Social Security Number (SSN). Income information includes. Social Security Credits, (SSI). Social Security benefits paid under Title II of the U.S. Social Security Act and Schedule C. E-File For ease of filing, IRS provides a number of free service options. You can submit the Form 1040 using the IRS e-file option. To determine if you are able to use e-file on your federal tax return or if any limitations must be met, please visit .

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Chandler Arizona Form 1096, keep away from glitches and furnish it inside a timely method:

How to complete a Chandler Arizona Form 1096?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Chandler Arizona Form 1096 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Chandler Arizona Form 1096 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.