Award-winning PDF software

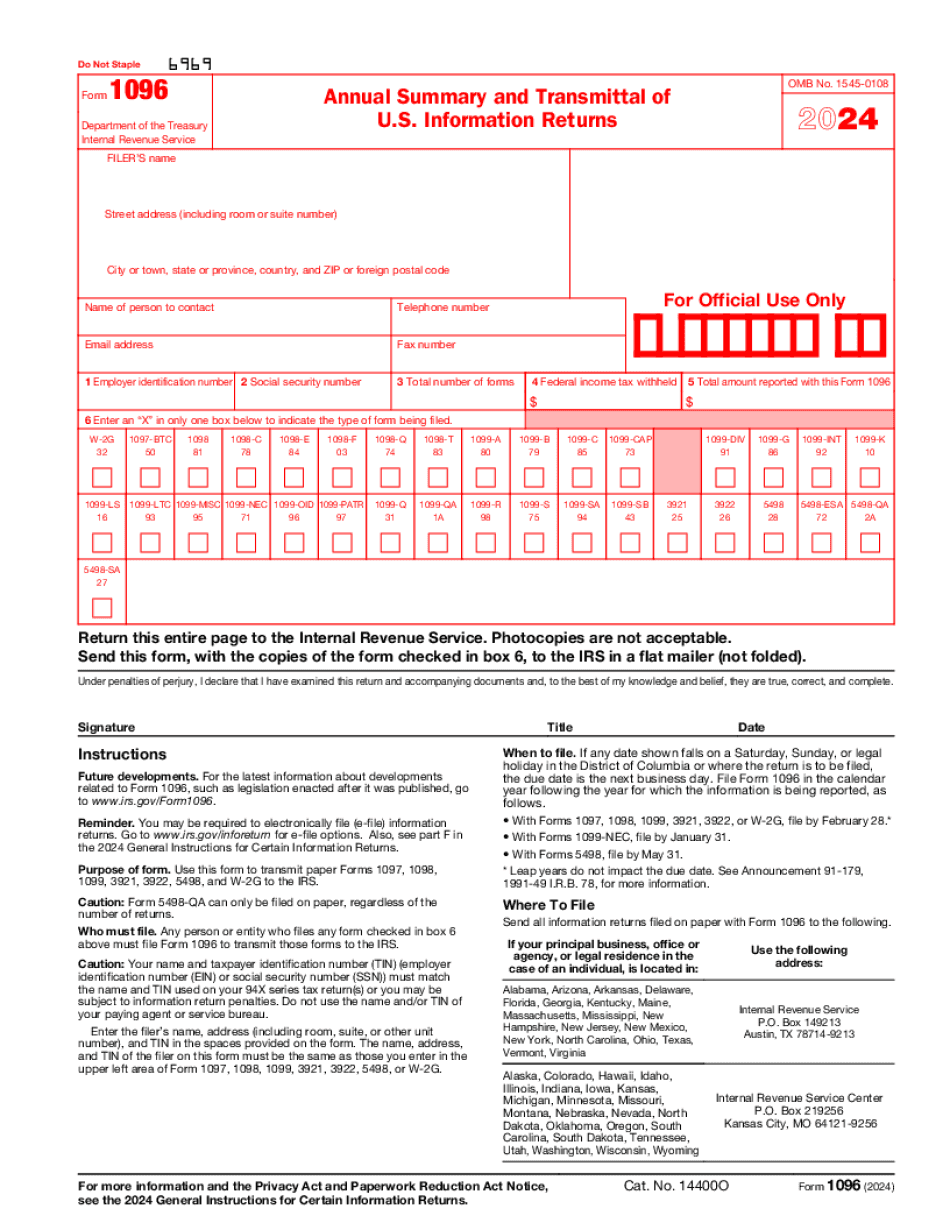

Form 1096 online Las Cruces New Mexico: What You Should Know

Bible Fellowship International (formerly known as Bible Fellowship) Bible Fellowship International is a network of evangelical churches throughout the world who have been dedicated to helping people of all ages and from all walks of life to discover the meaning, purpose, and life of the Bible. The Bible Fellowship International staff and volunteers work diligently to make this organization as inclusive as possible. Bible Fellowship is currently under investigation by the IRS for operating without a recognized tax-exempt status. Any organization involved with Bible Fellowship that received 5,000 or more from the organization must file Form 1099 and pay the 10% sales tax for the year in which they received the money. Forms are provided on our website in order to assist you with your reporting needs. The IRS does not allow the filing of tax returns by persons who are not United States citizens unless they are an individual who intends to reestablish overseas residency. Forms 1099, 10NR, 1099-B, and 1099 are the only authorized forms for reporting the income of U.S. taxpayers who reside outside the United States and have income generated outside the United States. If filing jointly, each joint return or statement of the income and deductions due for the taxable year must disclose the amount, date of receipt, and U.S. place of residence of each individual. Please be aware that you must use Form 8802, and Form 8802-EZ, to make a refund request. You cannot just send a Form 1099-MISC as a letter. There are several problems with the 1099. They are subject to audit and have an adverse impact on the U.S. budget. The 1099-MISC is used when a U.S. taxpayer makes an unpaid, cash-out exchange of foreign currency for the U.S. currency and has income generated outside the U. S. The U.S. dollar is treated as a foreign currency. In 2025 the tax revenue generated by this type of exchange was approx 3.6 billion. However, the IRS estimated the amount of U.S. earnings generated to be 20.7 billion in 2014. This was made from foreign currency exchanges made to convert foreign currency into dollars. There was no U.S. dollar gain or loss generated.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1096 online Las Cruces New Mexico, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1096 online Las Cruces New Mexico?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1096 online Las Cruces New Mexico aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1096 online Las Cruces New Mexico from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.